Do You Need Moving Insurance?

Moving is a huge project, even if you are just moving across the street. If you are hiring movers to help, that adds a whole new layer of complexity. Movers are professionals, but accidents can still happen. Getting insurance for moving will help protect you from high costs if the movers break your valued possessions.

While insurance helps everyone involved, it can be a hassle. Let’s look at the ins and outs of moving insurance. While you’re at it, check out this helpful article to get hot tips for making the best move possible.

Moving Insurance Coverage for Consumers

Let’s say you want to start in a fresh home. You decide that hiring a moving company will make your life easier. Moving insurance should be your top priority. Here are some basics to keep in mind as you consider your options:

Full Value Protection moving insurance is preferable.

Full Value Protection is the most expensive insurance, but it also fully protects your stuff. Expect to spend about 1-2% of the total value of your possessions if you pay for the insurance offered by the moving company. If you go with another insurance option, you may spend about $1.25 per pound. But keep in mind that prices vary depending on the company you use.

If any of your property is lost, damaged, or even completely destroyed, your mover is responsible for the full cost of that property. They will repair, replace, or pay you back for the items in question.

Remember to list special items that are extra valuable. These count as “extraordinary value” and won’t be covered unless you specifically write them down for the movers to be aware.

Released Value Protection costs nothing but comes with risks.

If you are looking to lower your moving insurance costs, Released Value Protection insurance costs zero dollars. However, the movers are only responsible for a fraction of the cost of any damaged items. They may only pay you 60 cents per pound. So if your antique sofa loses its legs in the move, you will only get a small amount of money to make up for it.

Keep in mind that you must specifically sign up for Released Value Protection. If you don’t choose a particular type of relocation insurance, the moving company may automatically put you under Full Value Protection—thus charging you more.

Does Renter’s Insurance Cover Moving?

It might! Before paying money to hire a moving company, make sure to read the fine print of your renter’s insurance policy. It will specify if and how it covers costs for damages to your property. If you are moving on your own, your renter’s insurance might protect you more fully. Hiring a moving company will mean you are putting your possessions into someone else’s hands, which may not be covered by your renter’s insurance.

Confused About Moving Insurance? LegalShield Can Help Clear It Up.

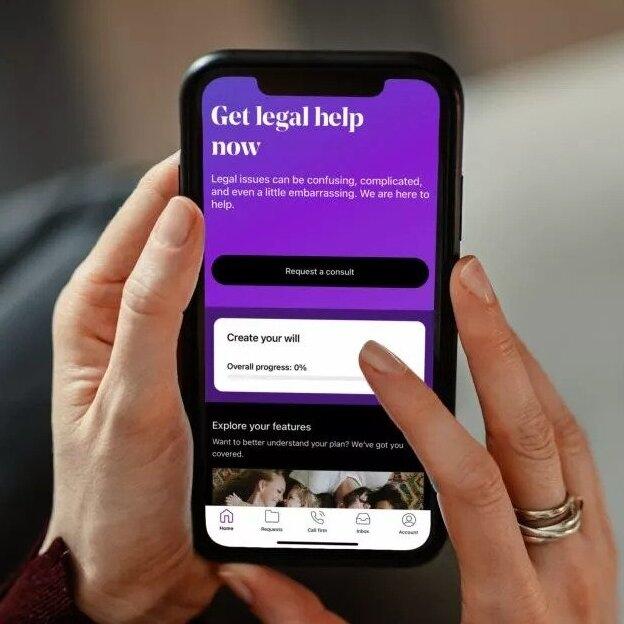

For anyone looking to hire help, moving company insurance is crucial. Figuring out what kind of insurance policies are best for you can get complicated. But a LegalShield Membership can help with that.

For a low fee that automatically renews every month, you can access an entire LegalShield provider law firm. You’ll get unlimited consultation on personal legal matters from your LegalShield provider law firm; review for paperwork; help with phone calls and letters; 24/7 emergency access for covered issues; a 25% discount off other legal problems; and assistance with many more legal needs.

LegalShield gives you the peace of mind you deserve as you make the best decisions possible about moving company insurance.

Pre-Paid Legal Services, Inc. (“PPLSI”) provides access to legal services offered by a network of provider law firms to PPLSI members through membership-based participation. Neither PPLSI nor its officers, employees or sales associates directly or indirectly provide legal services, representation, or advice. The information available in this blog is meant to provide general information and is not intended to provide legal advice, render an opinion, or provide any specific recommendations. The blog post is not a substitute for competent legal counsel from a licensed professional lawyer in the state or province where your legal issues exist, and the reader is strongly encouraged to seek legal counsel for your specific legal matter. Information contained in the blog may be provided by authors who could be a third-party paid contributor. All information by authors is accepted in good faith, however, PPLSI makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

Get the Power of Legal Protection